MHBP – health plans built for all federal employees

MHBP offers three health plans with great low rates and nationwide coverage.

MHBP offers affordable health plans for every federal employee

MHBP has three medical plan options designed to fit your lifestyle and budget.

With three plan options to choose from, MHBP has a health plan to fit your needs. Each plan offers comprehensive coverage at low rates and lots of great extras. And our dedicated 24/7 customer service (except certain holidays) is here whenever you need it.

Quick Links:

Share this page:

MHBP has been trusted by Federal and postal employees and retirees from more than 50 years. At the heart of the MHBP is health coverage. We offer three nationwide health plans backed by the strength of the Aetna network.

It’s important to compare. Depending on where you live, there are as many as 250 plan choices in the Federal program. And yearly premiums can vary by more than $10,000 between the highest cost and lowest cost plans. One feature that stands out is our customer service. We have dedicated MHBP representatives available to answer your questions. 24 hours a day, seven days a week, except major holidays. You can reach a representative when it’s convenient for you at 800-410-7778.

MHBP offers worldwide coverage. In the 50 United States, we are backed by the strength of a nationwide network from Aetna. The good news is all our MHBP plans offer in and out of network benefits. See the official plan brochure on MHBP.com for full coverage details.

There are no referrals required to see a specialist with any MHBP plan. You have access to one-on-one virtual visits on your computer, phone or mobile app. And we offer many programs and tools to help you reach your personal health goals. Now that you’ve heard the basics, let’s review each of the options. This is just a high-level summary, but you can review all of the plan details that our website, MHBP.com.

The Standard Option is our most popular plan. It offers comprehensive coverage at a very affordable price. This plan’s low copayments not only keep your costs down, they make your out-of-pocket expenses more predictable. When you use a network provider, the plan pays 100% for routine services like annual exams, lab tests, immunizations and maternity care.

With low copayments for most services, you know what you’re going to spend. For example, generic drugs from a network pharmacy are just $5. This plan also includes wellness rewards to help you get and stay healthy as you reach your personal health goals. When you need additional services like diagnostic tests or even surgery, the Standard Option’s comprehensive coverage has your back.

Next is our Consumer Option, which offers comprehensive medical coverage and a health savings account. MHBP contributes up to $2,400 tax-free each year for you to use for qualified medical expenses. The money is yours to spend or save.

The Consumer Option covers preventive care at 100%. That means no copayment and no deductible for network providers. So, you can get things like an annual exam, well-child visits, wellness screenings and immunizations at no charge. Once you meet your deductible, you’ll pay low copayments or nothing at all for your covered care.

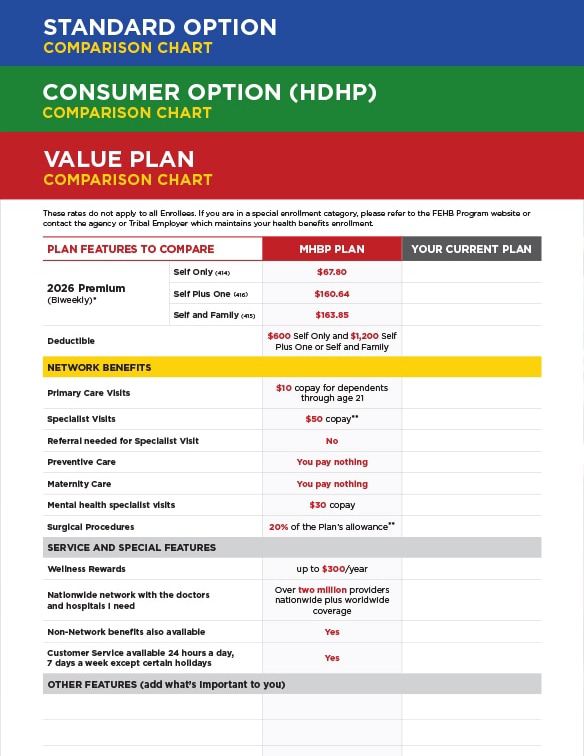

Finally, we offer the Value Plan. This plan provides simple, affordable coverage to protect you from the unexpected. The Value Plan focuses on affordability, and can be a good choice if you are looking for preventive care and the occasional visit to the doctor’s office, but still need protection from major expenses.

The Value Plan covers preventive care at 100%. That means no copayment, and no deductible for network providers. Other services, like specialist visits or hospitalizations, require copayments. You also have access to dental and vision plans at affordable group rates. You can enroll in this optional coverage throughout the year, even if you don’t have an MHBP health plan. You can also call one of our representatives at 800-254-0227 to ask questions or talk through your options.

The comprehensive dental coverage pays 100% for preventive visits twice a year. There are copayments for other services, which you can review online. The annual benefit maximum is $2,000.

Our vision plan offers nationwide coverage. You can get exams, lenses, contacts and frames for a low copayment. There’s even a discount for laser vision correction.

We realize this is a big decision for you and your family. That’s why we strongly encourage you to compare benefits and rates. Once you’ve done that, we feel confident that MHBP will have a plan for you. The OPM website at opm.gov/insure has a handy comparison tool, so you can look at your options side by side. Comparing the plans available in your area is important, as yearly premiums vary by more than $10,000. You can also call one of our representatives at 800-410-7778, 24/7 to ask questions or talk through your options.

As a Federal employee, you serve the needs of the country. At MHBP, we take that same care in serving you. Give us a call today and see how we can help.

Three plan options.

One mission — a healthier you.

Standard Option

Comprehensive coverage at an affordable price

The MHBP Standard Option is setting a higher standard for federal employee health benefit plans at a lower cost.

Consumer Option

Part health plan, part savings account that’s there when you need it

The MHBP Consumer Option is a high-deductible health plan with a health savings account (HSA).

Value Plan

A plan with your health care needs and budget in mind

The MHBP Value Plan is our most affordable plan. It provides you with protection against an unforeseen illness or event.

Why choose MHBP:

- 24/7 dedicated customer service team (except certain holidays).

- Outstanding plan satisfaction, per OPM.gov Consumer Satisfaction Survey Results. If you aren’t happy, we aren’t happy.

- A large, nationwide network of over 2 million capable care providers and hospitals. When you need care, it’s never too far.

- No referrals required to see a specialist. No jumping through hoops to see the right doctor.

- Worldwide coverage for living, working, or traveling abroad.

2026 STANDARD OPTION RATES

These rates do not apply to all Enrollees. If you are in a special enrollment category, please refer to the FEHB Program website or contact the agency or Tribal Employer which maintains your health benefits enrollment.

Federal Employees (biweekly)

- Self Only (CODE 454): $93.89

- Self Plus One (CODE 456): $216.12

- Self and Family (CODE 455): $218.20

Annuitants (monthly)

- Self Only (CODE 454): $203.44

- Self Plus One (CODE 456): $468.27

- Self and Family (CODE 455): $472.76

Postal service employee or retiree? Visit MHBPPostal.com for your rates and enrollment codes.

2026 CONSUMER OPTION RATES (HDHP)

These rates do not apply to all Enrollees. If you are in a special enrollment category, please refer to the FEHB Program website or contact the agency or Tribal Employer which maintains your health benefits enrollment.

Federal Employees (biweekly)

- Self Only (CODE 481): $95.99

- Self Plus One (CODE 483): $212.42

- Self and Family (CODE 482): $223.04

Annuitants (monthly)

- Self Only (CODE 481): $207.97

- Self Plus One (CODE 483): $460.25

- Self and Family (CODE 482): $483.25

Postal service employee or retiree? Visit MHBPPostal.com for your rates and enrollment codes.

2026 VALUE PLAN RATES

These rates do not apply to all Enrollees. If you are in a special enrollment category, please refer to the FEHB Program website or contact the agency or Tribal Employer which maintains your health benefits enrollment.

Federal Employees (biweekly)

- Self Only (CODE 414): $67.80

- Self Plus One (CODE 416): $160.64

- Self and Family (CODE 415): $163.85

Annuitants (monthly)

- Self Only (CODE 414): $146.89

- Self Plus One (CODE 416): $348.05

- Self and Family (CODE 415): $355.00

Postal service employee or retiree? Visit MHBPPostal.com for your rates and enrollment codes.

MHBP Plans at a glance

Please do not rely on this chart alone. Below is a summary of covered expenses for: Standard Option, Consumer Option and Value Plans. For more detail about definitions, limitations, and exclusions please refer to the Official Plan Brochure.

| Care Type (In Network) |

Standard Option | Consumer Option (HDHP) | Value Plan |

|---|---|---|---|

| Preventive Care | You pay nothing | You pay nothing | You pay nothing |

| Primary Care Doctors’ Visits | $20 copay, adult $10 copay, dependents through age 21 |

$15 copay* | $30 copay, adult $10 copay, dependents through age 21 |

| Specialist Visits | $30 copay | $15 copay* | $50 copay* |

| Lab Savings Program | You pay nothing for covered lab tests with the Lab Savings Program when Labcorp® or Quest Diagnostics® performs the tests | You pay nothing* for covered lab tests with the Lab Savings Program when Labcorp or Quest Diagnostics performs the tests | You pay nothing for covered lab tests with the Lab Savings Program when Labcorp or Quest Diagnostics performs the tests |

| Alternative Care (Chiropractic) | $20 copay per visit up to 40-visit combined maximum | $15 copay* per visit up to 40-visit combined maximum | 20% of the Plan allowance* up to 40-visit combined maximum |

| Alternative Care (Acupuncture) | 10% of the Plan allowance up to 40-visit combined maximum | $15 copay* per visit up to 40-visit combined maximum | 20% of the Plan allowance up to 40-visit maximum |

| Maternity | You pay nothing | You pay nothing* | You pay nothing |

| Emergency Room Visits | $200 copay*. Copay is waived if you are admitted to the hospital (No deductible for accidental injury) |

$150 copay*. Copay is waived if you are admitted to the hospital | 20% of Plan allowance* (coinsurance is waived if you are admitted to the hospital) |

| Urgent Care Center Visits | $50 copay | $50 copay* | 20% of Plan allowance |

| Hospitalization | $200 copay per admission and 10% of Plan allowance for ancillary services | $75 copay per day, up to $750 maximum per admission* | 20% of Plan allowance* |

| Prescription Drugs, Generic (30-day supply) | $5 copay | $10 copay* | $10 copay |

| Calendar Year Deductible | $350 Self only $700 Self plus one or self and family |

$2,000 Self only $4,000 Self plus one or self and family |

$600 Self only $1200 Self plus one or self and family |

*Calendar year deductible must be met first

Quest, Quest Diagnostics, any associated logos, and all associated Quest Diagnostics registered or unregistered trademarks are the property of Quest Diagnostics. Labcorp trademark is the property of Labcorp.

They’ve treated us like family. It’s just been the right fit for us.”

John G., MHBP member

Plans for a healthier you

Looking for a better health plan? Look no further than MHBP. With three MHBP plan options, find a health plan to fit your needs, with coverage at affordable rates. Download the brochure to learn more.

Shop. Compare. Choose MHBP.

How do you select the best plan for you and your family? Choice is a good thing, but choosing isn’t always easy. Compare your plan to MHBP and see if you can save.

Have questions? We’re here.

Get Live Help

Have questions or need help selecting a plan? We offer multiple ways to get live help. Don’t wait, our friendly representatives are here for you.

Providers are independent contractors and are not agents of Aetna. Provider participation may change without notice. Aetna does not provide care or guarantee access to health services.

Quest, Quest Diagnostics, any associated logos, and all associated Quest Diagnostics registered or unregistered trademarks are the property of Quest Diagnostics. Labcorp trademark is the property of Labcorp.

Information is accurate as of the production date but may change.